Hi guys, Phil McGilvray here from Grandma’s Jars. Thank you for joining us. We’re up to tutorial nine in our ten part tutorial series – our Top Ten Tips for Paying Off Debt. Now I am really excited about bringing you today’s tutorial because it’s putting the nuts and bolts together to build a road map to debt elimination and I love doing these because it gives people a vision of what’s possible, what they can achieve.

A Visual of a Real Debt Elimination Road Map

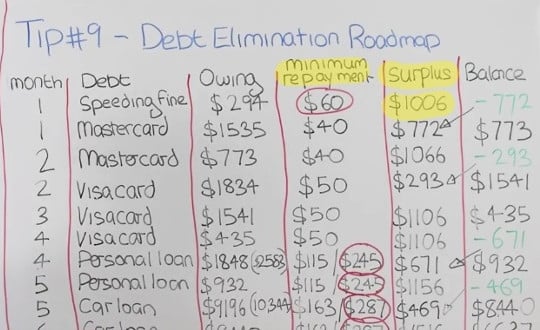

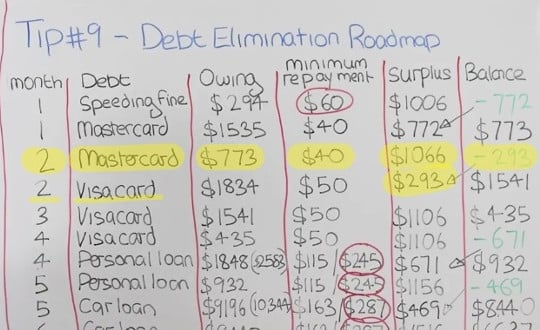

When you can see step by step how you are going to go from being in a lot of debt to debt free, it can be really exciting and really inspiring. So what I have got here is a road map that I have drawn on the board (which you can view in the video below as well), based on a case study that I was using in tutorial six: smallest debt first and tutorial seven: going interest only on your home loan. I have put all of their debt together and as best as I can I have put the process month on month how we are paying off each debt so you can see how it all occurs.

Watch the full video here:

Now, the problem is I have run out of room on the board so you haven’t got the whole process there but by the end I have no doubt that you will have a real good idea of how this works. So I am going to get stuck right straight into it because there’s a lot to cover. I hope it makes a lot of sense, as I said this is one of the most rewarding parts of my job as a budget coach.

The ‘Month’ Column

Ok, so starting over here in the left hand column we’ve got the month. So the month of each level we achieve in paying off each debt. Starting with the speeding fine, if you remember our client had a speeding fine, it was $294, he was paying $60 off a month. And that $60 is circled because that $60 is principal and that means that $60 does actually come off the $294 each month so it reduces that by $60 each month.

The ‘Surplus’ Column

In this column here, what we’ve got is the surplus. If you remember in tutorial seven: going interest only on your home loan, we decided we were going to pay the absolute minimum on all our loans. Now, the client had been scattergun approaching – paying a little bit extra off of all of these loans at different times. We stopped that. We said we would pay just the minimum on all of the loans, except for one at a time. And by doing that, we freed up $1,006 dollars that we can then purposefully channel towards one debt and then the next debt and the next debt and the next debt.

The Smallest Debt First

So you can see here the first debt we are starting with, the smallest debt first. We are going to put the $60 that he has to pay, plus the $1,006 which on a $294 loan. This obviously means that at the end of the day he’s got $772 extra up his sleeve once that debt has been paid off. So month one, speeding fine knocked off and we still have $772 to then focus on our MasterCard.

The Debt Snowball Taking Effect

MasterCard was $1,535 dollars and the minimum repayment was $40. Now, unfortunately all of that was interest, so none of that pays off the debt. But the $772 we had comes off the $1,535 and by the end of the month the MasterCard is down to $773.

Month two, we still have that MasterCard, we still have that $773 owing on it and we still have that $40 that doesn’t count because it’s interest. We’ve got $1,066 now as surplus. We only had $1,066 previously but because we no longer have the speeding fine, we now have that $60 available as surplus. This means halfway through month two, we have our Mastercard paid off and we have $293 up our sleeves to then throw at the Visa card.

The Visa card is $1,834. We’ve got a $50 repayment that is all interest, so no principal. We’ve also got the $293, just in surplus, and again, this is just in month two. So, by the end of month two, we’ve paid off the speeding fine, we’ve paid off the MasterCard, and we’ve reduced the Visa card down to $1,541.

So the start of month three, we’re starting with the Visa card. We have $1,541 and the $50 interest that doesn’t count. We’ve got $1,106 in surplus. Now you can see, that again, our surplus has gone up from $1,066 to $1,106 because we are no longer paying the $40 interest on the MasterCard. You can see that the snowball effect of the surplus getting bigger. So that $1106 is directed towards our $1,541 Visa card so by the end of month 3, our Visa card is down to $435.

Month Four

Ok we get to month four. Visa card, $435, minimum repayment $50 dollars and $1,106 in surplus.

So, halfway through the month we have more. We paid off the MasterCard, we have more than enough in surplus – $671 still in our sleeves – which we can then throw towards our personal loan which is the fourth debt, the fourth smallest debt, at $1,848.

Now, if you remember from our previous tutorials, the personal loan was actually $2,583. But because we had minimum repayments of $360 on those, $115 of that minimum repayment was interest but $245 was actually principal. So for month one, two, and three, this minimum $245 is actually coming off this personal loan. So even though we haven’t been focusing on it, the car loan and the personal loan, have been going down. So what happened is, the personal loan has gone from $2,583 to $1,848 in the months we have been focusing on these other debts.

So we have $245 surplus this month, plus we have $671 from the previous month. We can see what’s happened here is that we have now brought the personal loan down to $932. This has all happened by month four.

Month Five

In month five we have the personal loan again. We have $932 owing and $115 of the $360 they have to pay as interest. It’s probably less than that now because we brought the loan down, but let’s keep it simple. $115 is interest and $245 is principal. Again, you can see here that our surplus has gone up because we no longer have the $50 we have been paying on the Visa card. We’ve got $1,156 surplus, so by halfway through the fifth month, we now have the personal loan paid off and we have $469. This means we can start throwing everything at our last lifestyle debt, which is the car loan.

Lifestyle Debt Gone

Now you can see from that just how quickly we are progressing through these loans. If we continue with that, you can see that with the car loan, we had started with $10,334 when we met this client, but because he’s making $454 repayments of which $287 is principal, it’s also come down to just above $9,000 by the time we get to month five. And you can see very quickly, that by month seven here, this loan – his last lifestyle loan – has come down to $4,834. So this is by month seven. The surplus funds have grown to $1,516. You can see that in the next three months, we are going to have – that should be by about month ten or eleven – we are going to have the car loan paid off. All of this lifestyle debt completely gone. Plus, we are going to have $1,516, plus the $450 we have been paying, so we are going to have $1,966 extra that we can then throw at his home loan.

This is really exciting, I do this all the time with people and they are just amazed at how quickly things can occur when they focus. I hope it makes sense. If you’ve got any questions, please don’t hesitate to contact us.